Home Equity Loans vs. Equity Loans: Recognizing the Differences

Home Equity Loans vs. Equity Loans: Recognizing the Differences

Blog Article

Secret Factors to Think About When Making An Application For an Equity Lending

When considering applying for an equity funding, it is important to browse through different essential factors that can substantially impact your monetary health - Equity Loans. Recognizing the kinds of equity lendings readily available, evaluating your eligibility based on monetary aspects, and meticulously analyzing the loan-to-value proportion are crucial initial steps. However, the complexity strengthens as you look into contrasting interest rates, fees, and repayment terms. Each of these factors plays an essential role in determining the overall price and usefulness of an equity lending. By carefully scrutinizing these elements, you can make informed choices that straighten with your lasting economic objectives.

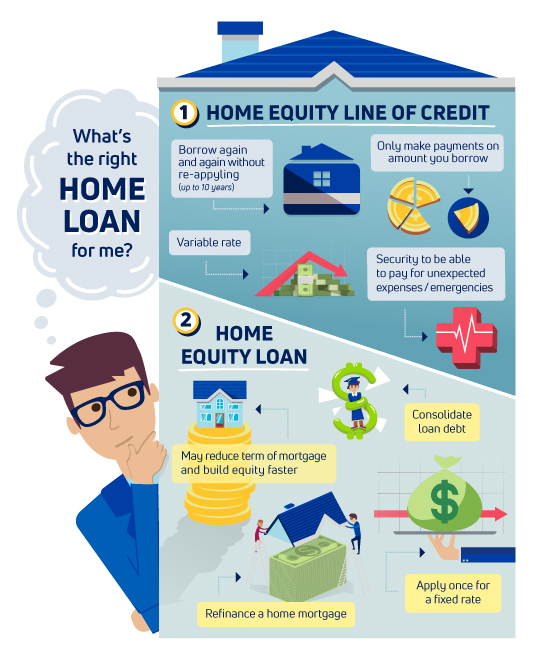

Kinds Of Equity Lendings

Numerous monetary establishments use a series of equity financings customized to meet varied borrowing demands. One common kind is the conventional home equity loan, where home owners can obtain a swelling amount at a fixed rate of interest, utilizing their home as security. This sort of lending is excellent for those that require a large amount of cash upfront for a certain purpose, such as home renovations or debt combination.

One more preferred alternative is the home equity line of credit report (HELOC), which functions extra like a charge card with a rotating credit rating limitation based upon the equity in the home. Customers can draw funds as required, approximately a specific restriction, and only pay interest on the quantity used. Equity Loans. HELOCs are appropriate for continuous expenditures or projects with unpredictable expenses

Furthermore, there are cash-out refinances, where home owners can re-finance their current home mortgage for a greater quantity than what they owe and receive the difference in cash - Alpine Credits Canada. This kind of equity car loan is helpful for those looking to benefit from lower interest rates or gain access to a large amount of cash without an added month-to-month settlement

Equity Lending Qualification Variables

When thinking about qualification for an equity loan, financial organizations typically examine variables such as the candidate's debt score, earnings security, and existing debt responsibilities. Revenue security is another essential variable, showing the customer's capability to make normal loan repayments. By very carefully analyzing these factors, financial organizations can establish the candidate's eligibility for an equity car loan and establish appropriate finance terms.

Loan-to-Value Ratio Considerations

Lenders normally favor lower LTV proportions, as they supply a greater pillow in instance the customer defaults on the finance. Customers should intend to maintain their LTV proportion as low as possible to boost their chances of approval and safeguard more positive financing terms.

Rates Of Interest and Fees Comparison

Upon examining passion rates and fees, consumers can click here for more info make informed choices concerning equity financings. Passion rates can significantly affect the total expense of the finance, impacting regular monthly payments and the overall quantity settled over the financing term.

Aside from passion prices, consumers must likewise think about the various fees linked with equity loans. Early repayment penalties may use if the customer pays off the funding early.

Settlement Terms Analysis

Effective assessment of payment terms is vital for consumers looking for an equity lending as it straight influences the loan's affordability and financial outcomes. The car loan term refers to the length of time over which the customer is expected to settle the equity lending. By thoroughly evaluating repayment terms, borrowers can make informed choices that straighten with their economic goals and guarantee successful car loan management.

Conclusion

To conclude, when using for an equity financing, it is vital to take into consideration the kind of financing readily available, eligibility elements, loan-to-value proportion, rates of interest and fees, and repayment terms - Alpine Credits Equity Loans. By thoroughly assessing these essential factors, borrowers can make enlightened choices that line up with their financial goals and situations. When looking for an equity finance., it is vital to thoroughly study and contrast options to make certain the finest feasible outcome.

By carefully examining these elements, economic organizations can determine the candidate's eligibility for an equity financing and establish appropriate car loan terms. - Home Equity Loans

Passion rates can dramatically impact the total cost of the financing, impacting month-to-month settlements and the total quantity paid back over the loan term.Reliable assessment of payment terms is essential for debtors seeking an equity funding as it directly influences the lending's cost and economic outcomes. The finance term refers to the length of time over which the debtor is anticipated to settle the equity funding.In verdict, when applying for an equity funding, it is vital to consider the type of finance available, eligibility aspects, loan-to-value ratio, passion prices and fees, and repayment terms.

Report this page